One very important concept to learn regarding taxes in retirement is that when there is only one source of income, either Social Security, IRA withdrawals or Capital Gains you could potentially pay no taxes. But the moment you add the presence of either one or more other sources of income you begin to drag in additional taxation which can create a tax torpedo. More on that torpedo later…

For example, in 2019 a married couple filing jointly can have as much as $105,750 in Long Term Capital Gains and if that is the only source of income, they could pay $0 in taxes.

Social Security as well, in the absence of any other income sources will not trigger federal income tax.*

IRA withdrawals up to a certain threshold again, in the absence of any other income will not trigger federal income tax.**

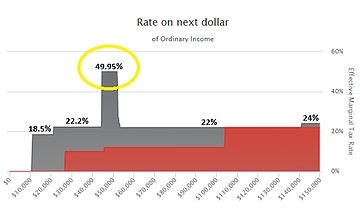

However, and this is a big however; when you have a source of income that on its own may not trigger federal income tax and then you add the presence of a 2nd or even 3rd income source your taxation can snowball out of control. This may be tough to identify or understand in your case, why? Whether you use Turbotax or a CPA you are probably being told that you are in a 12%,15%, 25% marginal tax bracket but that does not tell the whole story. The actual rate of taxation on those income sources may be as high as 44.95%.*** Simply adding some Social Security along with some ordinary income can torpedo your taxes up into this level.

Having a plan for where to take income from and when may allow you to be able to reduce or in some cases even eliminate certain taxes. Now that is an exciting prospect for retirement!

If you would like a plan that would do this, and allow you to forecast the impact of withdrawals from certain sources, please contact me

*2019. If there are any other income sources though, Social Security may be taxed.

**2019. IRA withdrawals will be taxed once they hit a certain threshold.

*** Effective Marginal Tax rate.