I’m not what one may call a car enthusiast, however I do recognize that they are complex pieces of machinery. Imagine for a moment that each component of your luxury vehicle had a different technician. So, for example, one tech worked solely on the transmission, another on the steering assembly, one on just the front suspension and one for the suspension on the rear. You even have a tech who works specifically on the piston crankshafts, completely independent from the piston tech (even though

they are physically connected.) The caveat is that they can’t see what the other techs are doing nor observe the work the other techs have completed. Would you be ok with that?

It’s quite commonplace for this same scenario to be exactly how people operate with regard to their finances and financial plans. You have a broker who manages your investment portfolio, or even just a part of it, and a tax professional who prepares your taxes. Your broker doesn’t see your tax returns though. What would he do if he did? Would he know what to look for and how the tax code works or is it more likely, that because he works solely on your portfolio, that he would miss items that could make you more money?

Here’s an example I see frequently and its simply a product of the financial services industry and how many Americans manage their money. Its not just a disconnect between brokers and accountants though, it goes further. Attorneys, Financial Advisors, Brokers, CPA’s etc. rarely work in unison to create a truly holistic total-financial-picture for clients. What if they did? The answer is:

You could keep more of what you earn.

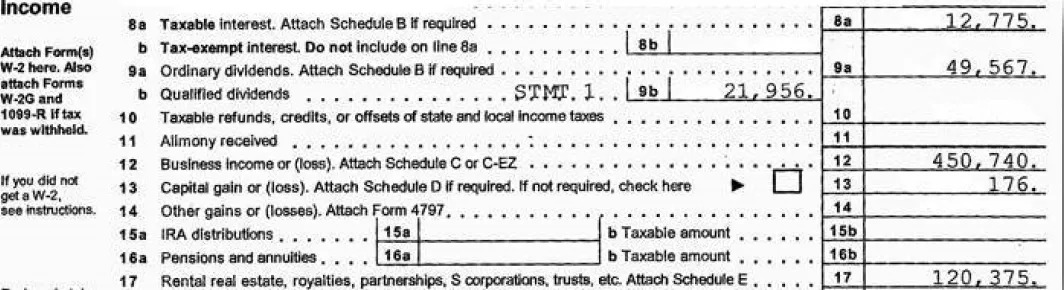

Look at the 1st page of your personal tax return (Form 1040) on line 8a, 9a & 9b. If there appears a figure there in excess of $1,000, there is likely a disconnect happening in your financial plan and your circle of professionals. If you are in a 35% or a 39.6%+ tax bracket then, you should review relevant and innovative ways to keep those funds from being taxed. If you don’t, the real return of those dividends is likely being greatly reduced by needless taxation.

Our firm and our team of CPA’s can easily provide you today with an innovative 2nd Opinion Tax Review. Does your financial plan pass all 5 tests under our Retirement X-Ray Report? Many professionals request these reports from us each month and their results are outstanding! Additionally, we may be able to obtain money from missed opportunities in previous years. We will help you position yourself today to get the most value out of your time. Contact us today!

Continue Reading The Ivy League AG Blog