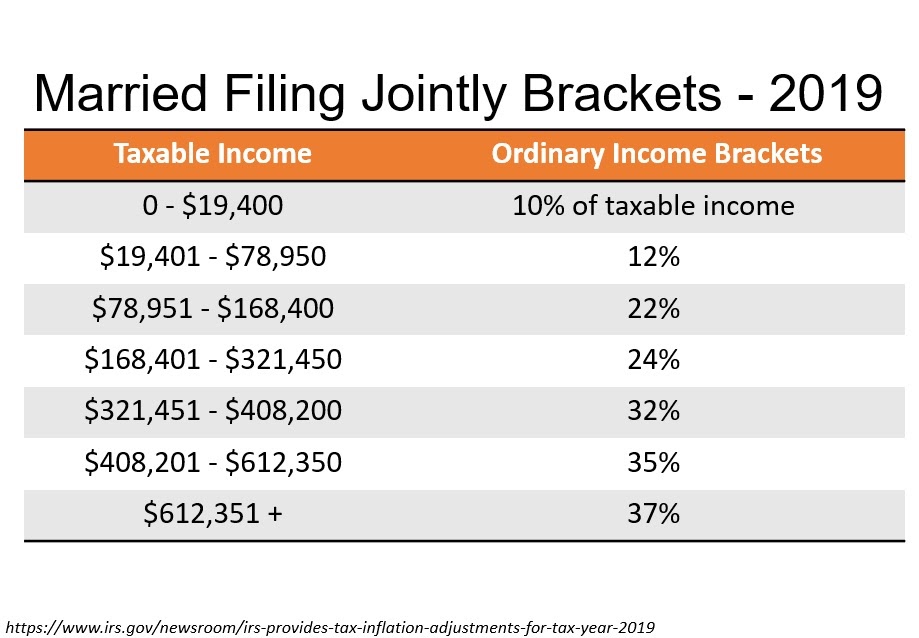

For starters, let’s look at our current marginal tax brackets.

Here’s a question for you though: If you are in the 12% tax bracket and you earn one additional dollar, will this have a significant effect on your taxes or will it affect your taxes only slightly? I find that there is much confusion regarding how this works. The truth is, only the last dollar falls into the next tax bracket. So if you only earned one extra dollar, that one dollar in the next tax bracket would affect your taxes slightly. Referencing the photo below, you can see that only the first $19,400 was taxed at 10%, then only the amount over that falls into the next bracket. In other words, only every dollar in the 12% Tax bracket cost me $0.12 in taxes. So our tax system is a progressive one.

I’d like to stress that this is a good thing because only the last dollars are taxed at that next marginal tax rate.

Now if this was all there was to the tax code, then it would probably work fairly intuitively. Over time though, Congress has introduced tax distortions that can create opportunities for those who plan correctly and pitfalls for those who do not.

If you’d like to learn how to use the last dollar strategy to your advantage or would like your own forward looking plan for retirement income, please