,Will the market make a quick recovery, and should that matter to you?

,Generally, the market goes down quickly and takes time to claw its way back up. Or put another way, takes an escalator up and an elevator down. Especially in light of recent news events that have created a bounce in the market, the following headwinds are sure to make this recovery long and drawn out. We probably have not seen the bottom of this. Here’s why:

- ,Uncertainty re: the election and its implication for economic growth & corporate taxes. Both of which drive corporate earnings.

- ,Corporate earnings drive stock values

- ,The Covid-19 closures and stay at home date projections are likely the tip of the iceberg. It is more likely this will continue for a minimum of 3 months.

- ,Broad and all-encompassing industries like energy, healthcare, financials, airlines, tourism/hospitality, consumer spending, (the list goes on) face a long road back to normalcy. The place from which they can rebuild is largely unknown as the measures to discourage the spread of COVID-19. In many cases, the stimulus may not be enough to stem the catastrophic losses sustained by specific companies.

- ,Several of the largest economies in the world face an import/export crisis, which may push these same economies into deeper bear markets and recession.

- ,The federal reserve can only inject so much currency into the markets.

,With these headwinds working against the sails of economic recovery when there is a recovery, we believe returns will be muted.

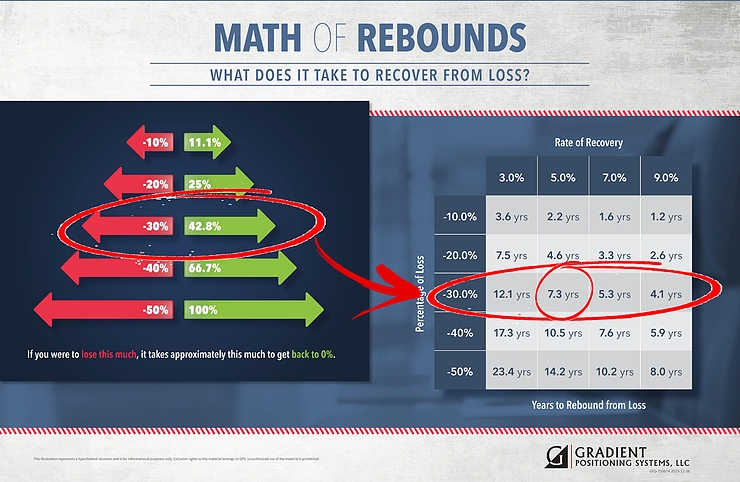

,The market as a whole has bounced up and down significantly during March. As a whole we can see a decline of about 30%. Let’s use that number to project out the potential recovery to your retirement assets. If:

- ,The market miraculously stopped declining today and never went down again

- ,The market provided a consistent 5% annual return

- ,The average time to get back to what you lost this year is 7.3 years.

,Ask yourself, though:

- ,Will the market stop declining today?

- ,Will it maintain positive performance for the next 7.3 years?

- ,Will it produce 5% returns?

,The math of rebounds details that if the market is down 30%, it will take a return of 42.8% to get back to 0%. See image below for details

,In light of the uncertainties facing markets globally, would it be wise to have downside protection in your retirement assets? In my next post, I’ll detail why downside will be critical to retirement success if you are less than ten years from your goal date for retiring.

,Are you looking for alternatives to minimize risk in your retirement assets? Please let me know, I’d be happy to discuss this with you. I can be reached at 866-360-2724 or via email at